is an American global investment management corporation based in New York City. This scheme essentially merges the Fed and Treasury into one organization.īlackRock, Inc. In other words, the federal government is nationalizing large swaths of the financial markets. to purchase these securities and handle the administration of the SPVs on behalf of the owner, the Treasury. What does this mean? In essence, the Treasury, not the Fed, is buying all these securities and backstopping of loans the Fed is acting as banker and providing financing. The Treasury, using the Exchange Stabilization Fund, will make an equity investment in each SPV and be in a “first loss” position. The Fed will finance a special purpose vehicle (SPV) for each acronym to conduct these operations. Now let’s get to a corporation that is going to be instrumental in this hebraic heist – BlackRock Inc. If it was not obvious enough, you can just turn to Wikipedia and learn: It’ll send individual checks to Americans and billions of dollars to institutions and businesses, and with Mnuchin overseeing it all, it’ll make him “ one of the most powerful Cabinet members in modern history,” The Washington Post writes. The House is set to pass a stimulus bill that addresses economic shortfalls caused by the COVID-19 pandemic on Friday ( or possibly Saturday). Treasury Secretary Steven Mnuchin will gain some unprecedented power from the coronavirus relief bill he helped write. Next let’s turn to Treasury Secretary Steve Mnuchin, Hollywood executive producer and former Goldman Sachs executive. He and his wife also joined Warren Buffett and Bill Gates in the Giving Pledge committing at least half of their money to charity.ĭid Gates give him any advanced notice about how Event 201 would become a “ live exercise“? One more point I found very interesting that he is connected to Bill Gates. This is just incredible, since jews are massively over-represented at Harvard, just like in the financial sector. For his honors thesis, he wrote a paper in 1988 called “Scaling the Ivy Wall: The Jewish and Asian Experience in Harvard Admissions.” While at Harvard he wrote a dissertation on the school’s admission policies. He said that’s why he decided to join the crew team to meet other Jewish kids. He found Harvard to be a pretty ‘WASPy’ place. Corona is the patron saint of money and gambling.Īnyway, I took a look back at some stories on Ackman and found some interesting nuggets from a 2012 Business Insider article:

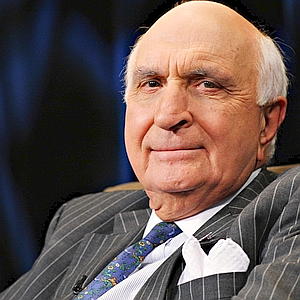

I knew the guy was jewish as soon as I heard about his successful gamble, but most Americans would not know this important fact. Ackman is a philanthropist who gives to Jewish causes, including five Jewish history, scholarship and arts organisations in New York. Below is what Jewish News wrote:Ī Jewish hedge fund manager in the US has said he made £2.2 billion from a £22 million bet on the effects of the coronavirus.

The hedge-fund billionaire turned a $27 million position into $2.6 billion through defensive hedge bets, a Wednesday letter to investors said.Ībove is the news for goyim. Pershing Square Capital Management CEO Bill Ackman minted a multibillion-dollar profit as coronavirus fears tanked US stocks. Most of you have probably heard about Bill Ackman, who made a massive amount of money by betting that the stock market would crash due to the coronavirus.

0 kommentar(er)

0 kommentar(er)